Vertical digital solutions for the leasing sector

Why choose Finwave?

Our solutions are modular and cloud-ready, based on workflows and are created using technologies recognized as standard at the banking and financial level.

We cover the entire spectrum of commercial, operating and compliance processes for end-to-end management of: finance leasing, rental, operating leasing and special-purpose financing.

Finwave operates with a consultancy-based approach, thanks to decades of experience in the sector and to its clients, which are some of the biggest players in Italy and abroad in the financial sector, and have chosen and successfully used our solutions.

- A single point of contact and a complete solution for all lending products

- Cloud-ready, technologically cutting-edge solutions to protect your investment

- The solutions are also offered with an SaaS / Cloud formula, with benefits including security, release times and reduced infrastructure costs (pay-per-use)

- Multidisciplinary approach able to facilitate integration with other contiguous or complementary business lines: Factoring, NPL, banking thanks to the adoption of specialized Finwave products

- Highly specialized skills in emerging technologies in the lending sector: blockchain, IoT (asset tracking), AI and Machine Learning (credit risk management)

Forward 3000

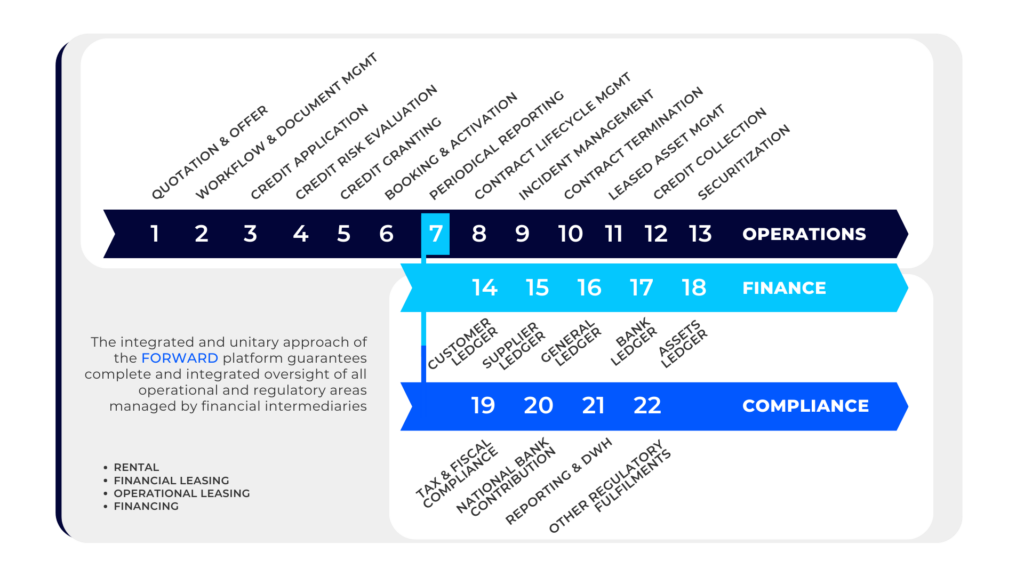

COMPLETE COVERAGE OF THE LENDING PROCESSES

Forward 3000 is a modular end-to-end leasing platform for the management of the entire operational and accounting process of finance leasing, rental and financing.

Main advantages:

- Multi-product coverage: rental, leasing, financing, dealer floor plan

- Multi-company and multi-channel

- Web-based and cloud-ready

- Complete coverage of financial broker and Banca d’Italia requirements

- Multi-Channel approach: operates on direct channels, via partners, self service

- Fully WEB solution, fully tablet/smartphone ready

Forward 3000 also includes a BPM which allows the application behavior to be differentiated at different company levels: company, product, channel, office, POS, single user.

This guarantees:

- That all activities are carried out by the operators in accordance with company best practice

- Smooth integration of a mixture of human interactions, validation of data and dialog with other company applications

- Process authorizations on the basis of the different user profiles

- Streamlining of processes, identifying the operating modes shared by multiple workflows and simplifying their structure

FUNCTIONAL COVERAGE

- Contract signing and activation

- Development of an amortization plan for assets

- Service management

- Commission management

- Management of post-sale contract changes

- Ordinary and early terminations

- Warranty management

- Asset management

- Securitization

- Construction/site management (SAL) management

- General accounting (balance sheets and consultations), customers (billing, collections, manual or automatic unpaid from SEPA CBI flows), suppliers (invoices, payments, due dates), banks (SDD, RIBA, collateral effects), owned assets

- Legal and tax compliance (VAT, withholding taxes)

- Treasury management Closing procedures (accruals/deferrals, amortizations, revaluations…)

- Management of credit securitization (transfer of part of the amortization plan)

- AUI registrations and SARA data submission

- Unified format and annual communication

- Italian Revenue Agency compliance (financial investigations, Esterometro, periodic VAT settlements)

- Bank of Italy surveillance reporting

- Operational and concentration risk

- Credit risk simulation procedure

- Central Register (CR) database

- CR regularization

- Anti-terrorism measures

- Contributions to external databases (e.g., CRIF)

- Complete privacy consent management for personal data and relationships

- Management of data retention periods and the right to be forgotten

- User profiling for access to functions, sub-functions, printing, and Excel exports

- Privacy ombudsman logs in cases of access to customers’

- Credit recognition

- Credit impairment

- Credit quality

- Credit collection

Forward Next

SALES ON INDIRECT NETWORKS / DEALERS

This is the digital onboarding platform for rental, leasing and loans, which can be integrated with the back office and CRM already available in the company.

Its workflow engine allows for integrated management of all multi-channel and multi-product sales networks with differentiated workflow and co-branding thanks to Web-ID – KYC – Credit Bureau – e-signature.

FUNCTIONAL COVERAGE

- Offer & quotation

- Financial terms exception

- Integration with public databases

- Automatic pre-check on databases + scoring (optional)

- Integrated documentation management

- Integration with sales support

- Credit application

- Integrated document management

- Access to databases, document list/integration

- Identification for AML (Anti-Money Laundering) check (digital

- Framework agreements, credit limits, and terms.

- Data/document validation

- Integration with Credit Bureau

- Automatic pre-resolution (optional)

- AML (Anti-Money Laundering) check – bureau verification

- Matching credit/offer

- Exception management for resolution

- Credit granting

- Printing

- Digital signature

- Compliance storage

- Offers

- Resolutions

- Contracts

- Volume reporting

- User profiles

- Sales network (hierarchy/dependencies)

- Types of assets

- List of ancillary services

- Automatic resolution rules

- Alerts and notifications

- Financial pricing

- Service pricing

- Fixed rate

- Variable rate

- Exception levels

- Marketing (Products and Services)

- Financial pricing

- Credit policy and exceptions

- Differential operational workflows

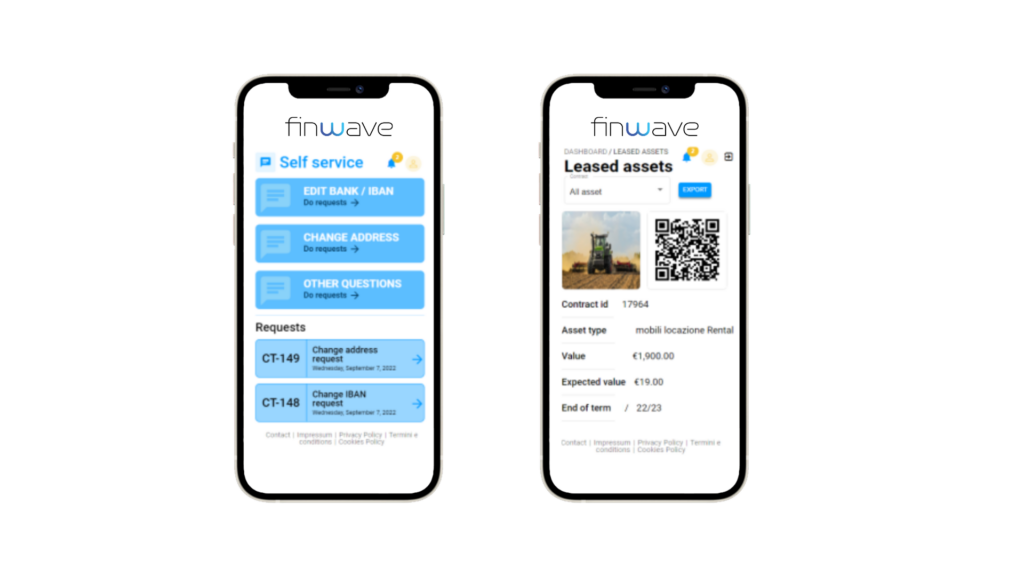

Forward Customer Portal

24/7 CUSTOMER SELF SERVICE ACCESS

Forward Customer Portal is an app dedicated to clients, active 24/7, which offers a complete range of self-service functions for the leasing sector.

3D – Augmented Reality

- Augmented reality view of rental assets

- Identification of the asset and all relative information using the contract QRcode

- AR asset display in 1:1 scale

4D – Connected Leasing (IOT)

- Level of use of each individual asset and of the fleet, grouped by individual client

- Geolocation and driving/parking time

- Driving style

- Crash detection

- Fraud analyzer for checkson accident reports

- Eco emissions – ESG

FUNCTIONAL COVERAGE

- It is a 24/7 customer portal with a complete range of self service functions:

- Consultation of contract data for active leasing contracts, assets, payments, invoices etc.

- Possibility to make change requests in a structured and controlled manner

- Access to the request processing status

- It handles customer support requests, which have traditionally been dealt with via phone/email, in an organized manner, following a standardized, structured and verified approach

- Dedicated configurable rules manage the automatic notifications on the processing status for requests from/to clients

- The lifecycle of the support request is managed via workflows and push notifications

- It offers provision for mobile devices

- It is securely integrated with the operational back-office platform already in use at the company

- Clients can also log on with their digital identity

- It is a completely mobile ready IoS / Android app