Vertical digital solutions for the management of UTP and NPL portfolios

Finwave’s highly innovative platform is able to handle the integration of the management phases of performing, under and non-performing (PAST DUE, UTP, NPL) credit portfolios.

DISCOVER OUR SOLUTIONS

Panda

Why choose Finwave?

The solution offered by Finwave, structured on the basis of logic based on the principle of full correlation between the individual administrative phases of the credit process, allows for effective and simplified management of the activities making up the entirety of performing and non-performing loans, from mapping and archiving of the input data to the appraisal and final decision, from the payment of the funds to the completion of the contract, from continuous trend monitoring to the determination of the accounting coverage for expected losses.

The new technologies adopted allow both development and maintenance costs to be contained, also ensuring the speed of development which is key for this market.

We cover the entire spectrum of commercial, operating and compliance processes for end-to-end management of loan products, both medium- and long-term: personal loans, mortgages, structured finance, both short term: document advances, invoice advances, RCF, FIN-IMP, FIN-EXP, RIBA advances, as well as the operations characterizing the integrated management of SPV, LeasCo and ReoCo.

Finwave operates with a consultancy-based approach, thanks to decades of experience in the sector and to its clients, which are some of the biggest players in Italy and abroad in the financial sector, and have chosen and successfully used our solutions.

Our strenghts:

- Technology. The specific technologies adopted allow the development and maintenance costs to be contained, while at the same time guaranteeing the accuracy and effectiveness of the final outputs.

- Speed. The structure of the Finwave operating system summarizes the positive nature of the management results of the total funds used, with the maximum possible reduction in execution times, whether those relate to complex restructuring of the credit exposure or normal continuous monitoring.

- Efficiency. The assessment logic identified by the data and correlated with them, which the Finwave software is based on, is calibrated in order to offer the best automated management solutions for the entire credit portfolio, whether this is performing or non-performing; the performance obtained is also constantly monitored and guaranteed through an integrated KPI and SLA service

- A single point of contact and a complete solution for all lending products

- Cloud-ready, technologically cutting-edge solutions to protect your investment

- The solutions are also offered with an SaaS / cloud formula, with benefits including security, release times and reduced infrastructure costs

- Multidisciplinary approach able to facilitate integration with other contiguous or complementary business lines: Factoring, lending, banking thanks to the adoption of specialized Finwave products

Panda

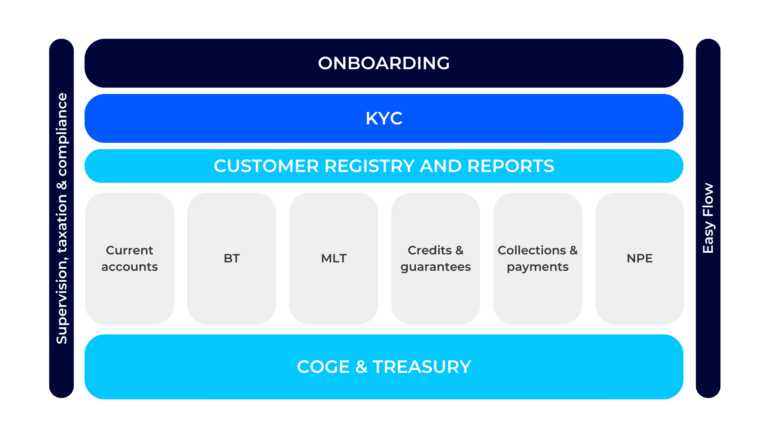

FROM ONBOARDING THE CREDIT PORTFOLIO TO DETERMINING THE PROVISIONING LEVEL

Panda is financial management software based on a web platform. The application is composed of different modules, including ones for UTP and NPL portfolio management, which can be activated in accordance with client requirements, to support the management of the business processes of the financial operator.

Panda is aimed at both traditional operators (credit institutes) and new players carrying out financial activities with different roles (master servicer, special servicer, credit and debit funds etc).

The solution covers the entire process of customer data management through to supervisory reporting, including all compliance requirements: AUI, ARF, transparency, supervision, anti-usury.

Of particular relevance is the methodological setting of the trend monitoring focused, in addition to breakage protection, on the complete and scrupulous application of criteria defined by the most recent Italian and supranational regulations regarding defaults, as well as use of expert automated early warning systems with an architecture based on particular connections between mathematical and statistical references and new empirical/experience-based evaluation logic of credit/financial risk events.

The system is based on a microservices architecture, with the back end developed in Java, and the front end developed in Angular.

Once onboarding has been performed, it develops an omnichannel coordination of the customer base via open management which is flexible to the different requirements of the credit broker, and is able to realize an enormous range of intervention measures on the credit exposure thanks to the numerous possible restructuring and modification operations relating to the repayment and amortization plans, the periodic collection of the installments and the transfer of the liquidity flows, the disposals made and the various revolving types for loans and lines of credit etc.

FUNCTIONAL COVERAGE

- Massive data loading for records, relationships, assets & appraisals

- Data update management

- Adequate verification MiFID (Markets in Financial Instruments Directive)

- FATCA (Foreign Account Tax Compliance Act)

- CRS (Common Reporting Standard)

- Calendar management

- Event management

- Document management

- Alert management

- Deadline management

- Prospect management

- Integrated customer position card

- Relationship management

- Unified data management (customers, suppliers, CTP, etc.)

- Relationship management

- Management of BT&MLT

- Credits Movement Management of plans (ITA, FRA, DEU, Custom)

- NPE (Non-Performing Exposures)

- Management Debt restructuring

- New finance

- Issued Guarantees

- Pool Management

- Due date calendar

- Inventory

- Unpaid past dues

- Management of simple credit lines

- Management of mixed credit lines

- Management of omnibus credit lines

- Management of real guarantees

- Management of personal guarantees

- Management of connections

- Management of movable assets

- Management of real estate assets

- Owners’ records

- Lot management

- Appraisal management

- Appraisers’ records

- SCT

- SDD

- SEDA

- SWIFT

- Sanction

- Placement

- Multicurrency

- Transaction handling DCD (Documentary Credit)

- Account management

- Account statements

- Inventories

- Accounting records

- General ledger

- Books

- Trial balance

- Financial statement

- Business plan

- Collections

- Accounting transactions

- Interest accruals

- Accounts payable cycle

- Recurring expense management

- Expense allocation

- Account statements

- Integrated Multi-Tenant Management for SPV (Special Purpose Vehicle), LeasCo (Leasing Company), and ReoCo (Real Estate Company)