Vertical digital solutions for Securities Services

Why choose Finwave?

Teams specialized in integration projects based on the IBM Data Stage platform, and in end to end transformation projects for resizing of bank mainframe platforms to cloud-ready microservices based environments, including through the use of No-SQL DBs.

Through the integrated platform (RMT) it is possible to perform real-time monitoring of the treasury risks relating to the financial portfolios of banks, holding companies, EMIs, asset management companies and other financial institutions.

Using the Integration Middleware Suite (Gtway), we optimize and simplify the interoperability between the various application platforms by validating and transforming the data flows, with a specific focus on the banking sector.

- Unique point of contact with specific solutions for the management of securities services (application solutions, custom projects, application management services, full outsourcing, cloud-ready solutions)

- Highly specialized skills in process and regulatory consultancy (post trading & settlement, risk management, tax service)

- Continuous relationship over the years, with solutions which are always up to date

- Specific expertise and partnerships in emerging technologies in the securities service sector (Microservices, Kafka, Kubernetes, Openshift, MongoDB)

- IBM DataStage center of expertise for Lutech Group

- Multidisciplinary approach and knowledge of banking IT systems able to facilitate systems integration projects

FUNCTIONAL COVERAGE

Securities, funds, asset management, order gathering, order booking, online trading, corporate action, Consob requirements, MIFID, due diligence, owned securities management (IAS), financial markets, info providers etc.

Institutional customer services, SSI, netting, clearing, matching, settlement, asset service, messaging: RNI, Swift, XML; integration of Italian and foreign CDS, T2S, ECMS-Score, ESMIG, CC&G , settlement circuits etc.

ALM, VAR, Convexity, Duration, RCSA, operational limits, derivatives, pricing, performance, credit risks, RWA, credit monitoring, stress tests, maturity ladder etc.

Position keeping, dashboards and forecasts, real-time querying of core systems, management of intermediary accounts (service banks) or direct accounts (Target 2), Kondor Plus integration expertise

Italian taxation, capital gains, dividends tax, withholding, Level 2 bank reporting, USD IRS Tax, recovery of double taxation withholding

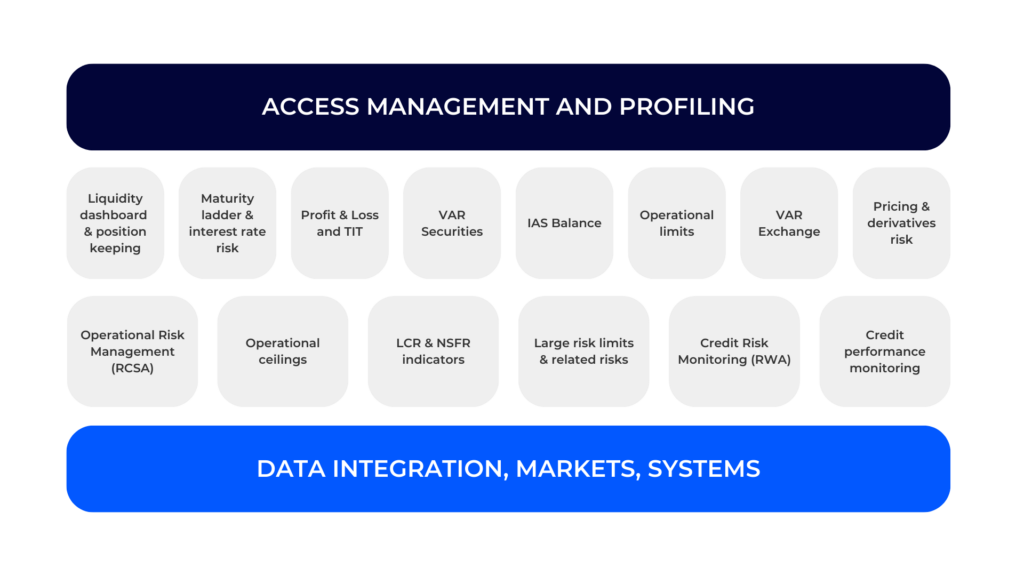

RMT Platform - Risk Management & Treasury

RMT—Risk Management & Treasury is the solution for integrated management of treasury operations and for real-time monitoring of the risk and performance of financial portfolios.

This completely modular solution allows the use and start-up of various operational components depending on the requirements of the end client. The “Access management and profiling” and “Data, markets, systems integration” modules allow for fast, simplified connection with the client’s IT and operating system.

The solution offers integrated management of:

- Liquidity – Position Keeping dashboard

- Maturity Ladder and tax risk

- Profit & Loss and TIT

- Securities Risk Management – Securities VAR – Stress Test

- IAS balance sheet management

- Operational limits

- Exchange positions management – Exchange VAR

- Derivative instruments pricing and risk

- Operational risk management (RCSA)

- Market data and IT systems integration

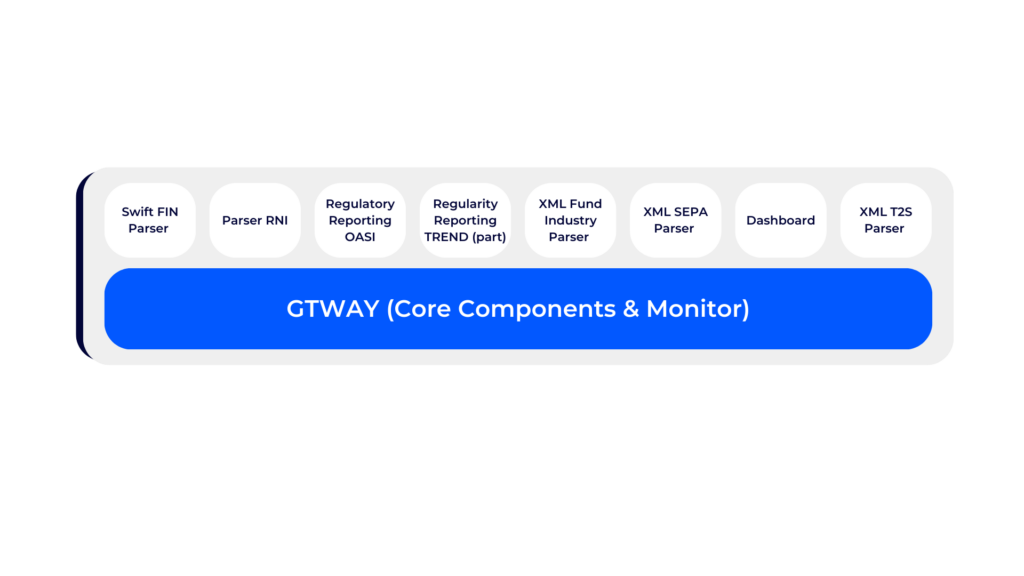

Gtway Suite - Integration Middleware

The “Gtway” – Integration Middleware application solution was created in order to facilitate the transmission, validation and transformation of flows of different formats (CSV, fixed-length, Swift, XML …) with a specific focus on the banking area, where the heterogeneous nature of the procedures and the environments requires a high level of customization and high processing performance. Moreover, years of participation in the ABILAB Investment Funds Observatory allows us to provide a specific solution which is always up to date with the specified guidelines.

On the basis of the banking and financial experience we have gained over the years, we have been able to develop specialized modules for the sector’s main needs and requirements.

It is supplied as a suite with multiple modular components.

The main functions/modules are:

- Connection libraries (Coda, FTP, Web Service …)

- Analysis, validation and mapping of the flow

- Events and activities scheduling

- Execution of existing or customized operations and transformations

- Events and procedures logging